Table of Contents

Want to Boost Rankings?

Get a proposal along with expert advice and insights on the right SEO strategy to grow your business!

Get StartedWritten by Dileep Thekkethil

- Updated Nov 5, 2025

Reading Time: 14 min read

Are you frustrated about your payday loan site not getting enough visibility on Google and other search engines?

With strict ad restrictions, intense competition, and compliance hurdles, getting your website ranked higher can feel like an uphill battle.

But don’t worry. SEO for payday loan sites is your one-stop solution. It can get you all that you need: more online visibility, more traffic, more leads, more signups and more people filling out your loan application forms.

I’ll walk you through the targeted strategies we use at Stan Ventures when providing SEO services for payday lenders. This will help you better understand how you can leverage SEO for payday lenders strategically to get your site ranked on Google’s first page, making it easily visible for potential borrowers.

What is SEO for Payday Loan Sites?

SEO for payday loan websites involves optimizing your payday lending website and content to rank higher in search engine results while staying compliant with strict financial industry regulations.

Free SEO Audit: Uncover Hidden SEO Opportunities Before Your Competitors Do

Gain early access to a tailored SEO audit that reveals untapped SEO opportunities and gaps in your website.

Unlike traditional SEO, search engine optimization for payday loan companies requires a careful balance between visibility and compliance to ensure your site attracts traffic without making misleading or non-compliant claims.

In fact, Google also introduced the Payday Loan Algorithm Update, specifically targeting spammy queries, blackhat practices and spammy sites.

That said, ethical SEO practices are a must to rank your payday loan site higher and dominate search results like a pro.

With the right SEO strategy, you can position your payday loan website in front of borrowers who are actively searching for short-term loan solutions.

That’s the secret sauce of successful payday loan lead generation using SEO.

Why is SEO Important for Payday Loan Websites?

SEO is a must-have for payday loan sites. Here’s why.

Attract Borrowers at the Moment of Need

People don’t browse for payday loans casually. They search for you when they urgently need cash. SEO ensures your website is visible to them at that critical moment, driving high-intent traffic organically.

Build Credibility and Trust

Creating high-quality content is an integral part of SEO. In a heavily scrutinized industry like payday loans, ranking higher with compliant and helpful content helps establish your brand as a trusted place to go for borrowers.

Zero Down on Ad Spend

With Google Ads and social platforms heavily restricting payday loan ads, SEO gives you a sustainable edge. Organic visibility puts your business in front of borrowers 24/7, without any ad spend.

Increase Conversions

An SEO-optimized payday lending website offers a smooth user experience that builds trust, reduces bounce rates, boosts rankings and ultimately improves your conversion rates.

Drive Long-Term Business Growth

Unlike paid ads, which stop delivering when you stop spending, SEO lays the foundation for long-term traffic generation. The content and links you create today can continue generating leads for months or even years, giving you a competitive edge.

How to Implement SEO for Payday Loan Websites: 10 Actionable SEO Strategies for Payday Lenders

Check out the proven SEO strategies for payday loans below.

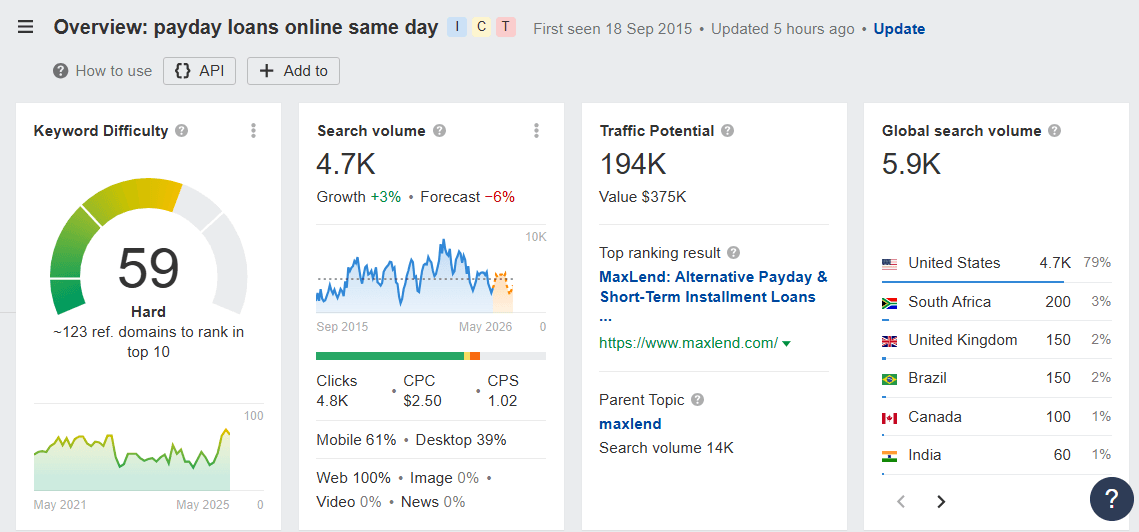

1. Perform Industry-Specific Keyword Research

Keyword research for payday loans helps you identify the terms potential borrowers are using to search for payday loans online.

By including these keywords in your content, you increase your chances of appearing in search results when users look for short-term loans or quick cash.

Make sure your payday loans-related keywords are a mix of broad keywords, long-tail keywords and local keywords (if you are a multi-location business).

Especially, long-tail keywords like “same-day payday loans near me” allow you to attract users who are ready to borrow money.

Use tools like Ahrefs and Semrush to find keywords with a good search volume, reasonable competition, and traffic potential.

Pro tip: Prioritize commercial and transactional intent keywords that drive qualified traffic and trigger conversions.

2. Create High-Quality, Trust-Building Content

Since your business deals with sensitive topics like short-term borrowing, debt management, and financial emergencies, it’s crucial to build trust with your audience.

Google also enforces strict E-E-A-T guidelines, especially for YMYL (Your Money or Your Life) sites like payday lending.

Given the scenario, content marketing for payday loans is your trump to position yourself as a trusted authority in your industry.

So, how do you execute that?

Publishing high-quality, user-engaging blog content is one of the best ways to establish credibility and demonstrate thought leadership.

Write informative posts that address borrower concerns, such as “How do payday loans work?”, “Tips for repaying loans on time,” or “What to consider before taking out a payday loan.”

Also, create FAQs and resource guides that address common concerns like “What are the repayment terms?” and “What happens if I miss a payment?”

Make sure your content is optimized with appropriate legal disclaimers and compliance language to avoid penalties. When borrowers feel informed and safe, they’re more likely to trust you with their financial needs.

3. Focus on On-Page SEO for Payday Loan Websites

On-page SEO for payday lenders ensures that both search engines and potential borrowers clearly understand what your website has to offer.

Optimizing on-page elements helps improve your payday loan website’s ranking for relevant queries. Plus, it bolsters engagement and conversions by making your pages more readable for users.

Here’s what you need to focus on for on-page optimization.

- Meta Tags: Write compelling meta titles and descriptions that naturally include your target keywords. Keep them clear and click-worthy.

- URL Structure: Use clean, short, and descriptive URLs to make your pages more easily discoverable.

- Header Tags: Structure your content with keyword-optimized headers (H1, H2, H3) that help users quickly scan your page and search engines index it effectively.

Remember, every small detail matters in SEO.

If you need help optimizing your on-page elements effectively for maximum SEO results, never hesitate to leverage the professional on-page optimization service offered by our SEO agency for payday loans. We are always happy to help.

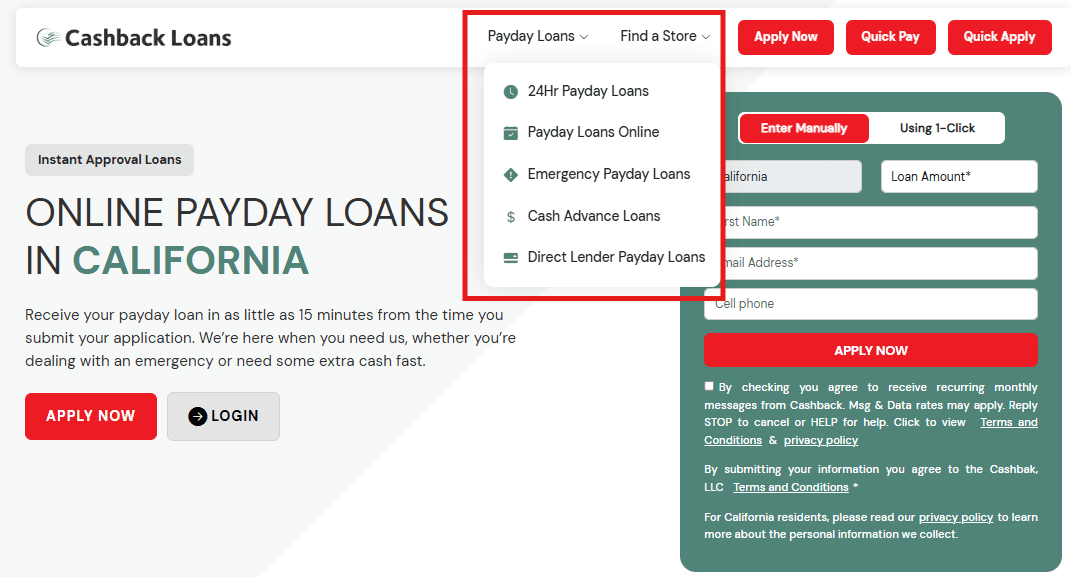

4. Create Dedicated Payday Loan Service Landing Pages

If you offer different types of payday loan services, such as same-day loans, emergency payday loans or no-credit-check loans, you need to build individual landing pages for each service.

Having these dedicated service pages gives you more opportunities to rank for long-tail, high-converting keywords while helping borrowers quickly find the solution they need.

Use each landing page to explain the unique features of that specific loan type, highlight borrower benefits, and address any common concerns.

Optimize each page with:

- Targeted keywords relevant to the service type and location

- High-quality visuals or charts (e.g., loan breakdowns)

- Clear calls to action that guide users to apply or get in touch

This approach not only improves SEO but also builds trust and makes it easier for users to take the next step.

5. Implement Strategic Internal Linking

Internal linking is more important than you think it is.

Organize your blog posts and landing pages into content clusters, where each topic links to related articles using contextual internal links. For example, a pillar page on “How to Get a Payday Loan” can link to blog posts like “Documents Required for Payday Loans” or “Common Reasons for Loan Rejection.”

The internal linking structure enhances user experience by seamlessly guiding borrowers through each step of the loan process. Plus, it helps search engines understand the depth of your content. As a result, you will get more online visibility for niche-focused search queries,

When executed right, internal linking can turn your payday loan site into a go-to place for borrowers.

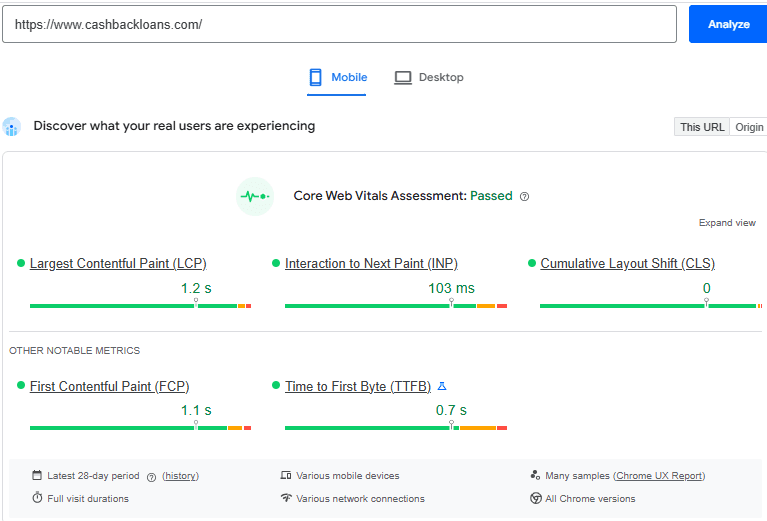

6. Maintain a Fast-Loading & Mobile-Friendly Payday Loan Website

Many brands ignore technical SEO for payday loan sites. Make sure you aren’t one of them.

Visitors looking for payday loans want fast answers and even faster access to funds. If your website takes more than 2-3 seconds to load, you risk losing borrowers before they even see what you have to offer.

Also, with over 60% of users performing online search on mobile devices, if your payday loan website isn’t mobile-friendly, you’re missing out on a huge share of potential borrowers who might have otherwise filled out your application form.

Two problems, one solution.

Choose a clean, user-friendly web design that loads quickly and adapts seamlessly to all screens, including desktop, tablet, and smartphone. Use minimalistic layouts, avoid heavy plugins, and optimize your images to improve page loading speed.

Add clear call-to-action buttons on your mobile site to make it easy for users to get in touch with you or apply for a payday loan seamlessly without zooming in or hunting for your contact details.

Don’t forget to implement image SEO best practices. Compress images, add descriptive alt text, and use supportive image formats like JPEG or WebP to speed up loading.

Use tools like Google PageSpeed Insights to monitor and improve your site’s performance across devices.

These payday lender digital marketing strategies ensure that your site is technically strong every step of the way.

7. Implement Schema Markup

Schema markup helps search engines understand your content and display results like star ratings, FAQs, and business info. This helps your payday loan site stand out in search.

Use FAQ schema to highlight borrower questions, or Local Business Schema to showcase your content details, address, and hours. This improves visibility and builds trust before users even click.

Tools like Google’s Structured Data Markup Helper or plugins like Rank Math make implementation simple. Always test your schema with Google’s Rich results test to ensure it’s error-free.

Even though schema won’t directly boost rankings, it improves how your listings appear in search results, and that can drive more qualified clicks.

8. Invest in Payday Loan Link Building

Backlinks are like votes of confidence from other trusted websites. Earning high-quality backlinks from authoritative financial, credit, and news platforms can significantly boost your payday loan website’s credibility in the eyes of Google.

This way, you can improve your chances of ranking higher for competitive loan-related keywords.

Besides, backlinks from relevant and reputable sources can drive high-intent referral traffic to your website. As a result, you get more loan applications filled.

Want to see how link building can increase traffic for payday loan sites like yours? Let’s take Nimble, for example.

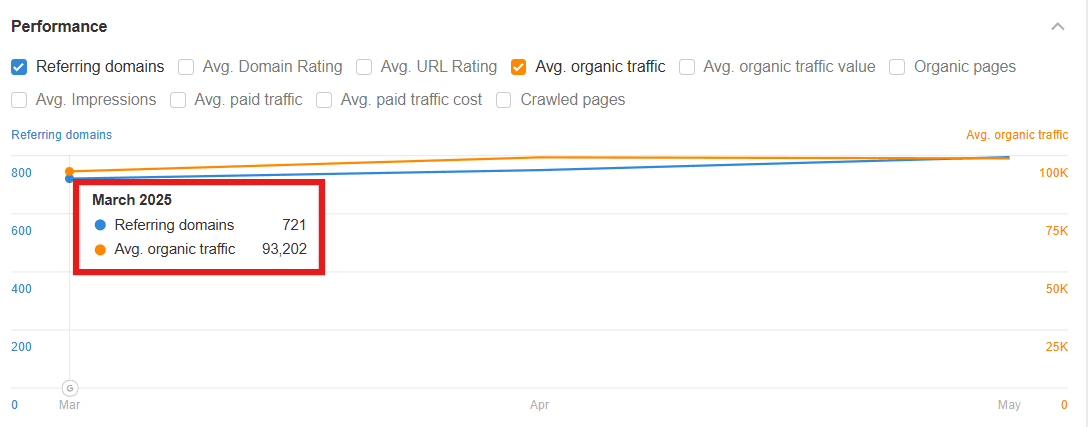

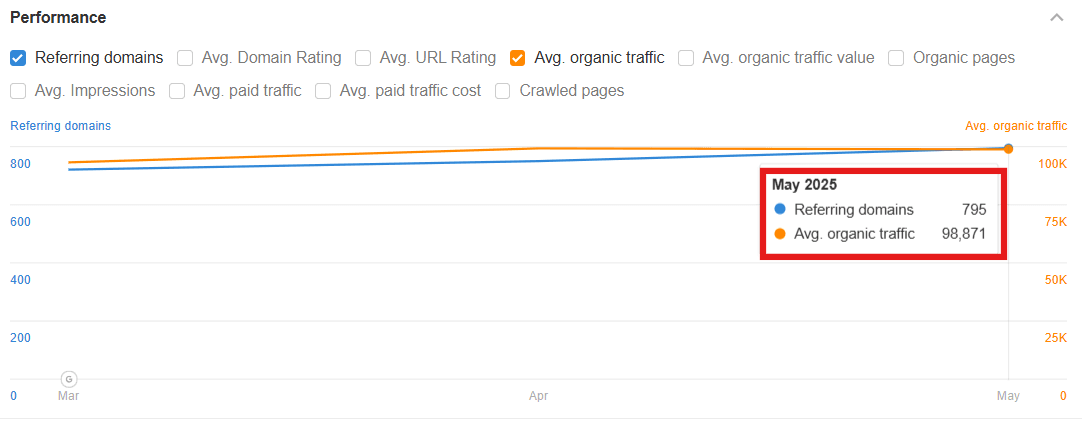

In March 2025, they were generating 93.2K traffic organically, with 721 websites linking back to them.

By building backlinks consistently, they generate 98.8K organic traffic with 795 referring domains as of May 2025. That’s a 5.5K+ increase in organic visitors to the site in just 3 months.

Imagine an addition of just 74 more domains making it work for Nimble. See the organic traffic growth syncing pretty well with the increase in referring domains in the graph below.

Guest posting on relevant blogs is one of the most effective ways to earn powerful backlinks. Focus on creating value-driven guest post content pieces that drive qualified traffic to your website.

You can also boost your backlink profile by listing your payday loan business in reputed local directories and loan comparison websites. These backlinks from credible sources can boost your authority and increase your visibility in local searches.

If you think you need a helping hand managing your link building needs, consider partnering with a trusted provider like Stan Ventures. Our comprehensive backlink building services cover everything, from blogger outreach and guest posting to content creation and contextual backlink placement, to drive significant SEO results for your brand.

9. Focus on Local SEO to Attract Nearby Borrowers

Local SEO for payday loans is critical for lenders aiming to attract borrowers from nearby neighborhoods and communities.

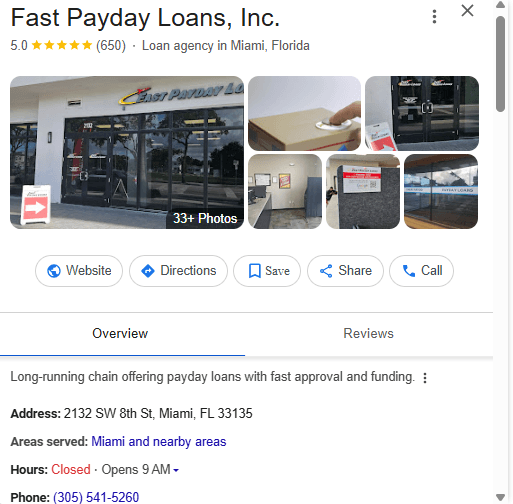

Start by verifying and optimizing the Google Business Profile, also known as Google My Business, for payday lenders.

Ensure that your business name, address, and phone number (NAP) are consistent across all directories and platforms—your website, social profiles, and business listings. This consistency signals trust to both Google and potential borrowers, improving your visibility in local search results.

Include location-specific keywords like “payday loan in [City]” or “fast cash loans [City]” in your GBP and website content to prompt your listings to appear when users search for lending services in your area.

Embedding Google Maps on your website further reinforces address accuracy and helps local customers easily locate your storefront.

10. Monitor SEO Performance

SEO isn’t a one-time setup; it’s an ongoing strategy, especially in a sensitive industry like payday lending, where compliance and user behavior constantly evolve.

Use tools like Ahrefs, Semrush and Google Analytics to monitor key performance metrics, including organic traffic, keyword rankings, bounce rates, and conversion rates. These insights help you identify what’s working and where borrowers are dropping off from the funnel.

Stay alert to regulatory changes and industry-specific SEO updates, particularly those affecting payday lending keywords, claims, and content standards.

Refine your SEO strategy consistently based on user search trends, algorithm updates, and market behavior. This ensures your SEO stays relevant, competitive, and fully aligned with both Google’s best practices and your industry regulations.

What are the Ethical Considerations for Payday Loan SEO?

In payday loan SEO, staying compliant is essential. Google’s policies are strict, and one misstep can cost you visibility and trust. Here’s how to keep your SEO strategy ethical and effective.

- Avoid Black Hat SEO: Avoid using spammy backlinks, keyword stuffing, cloaking, or hidden content. These tactics may offer short-term boosts but often lead to penalties or deindexing. Stick to sustainable, white-hat SEO strategies that build long-term value.

- Maintain Transparency and Trust: Be upfront about loan terms, fees, repayment conditions, and approval timelines. Avoid vague language or exaggerated promises like “no credit check” if it’s not 100% accurate. Make sure every piece of content reflects your real offerings.

- Compliance: Follow all local, national, platform-specific regulations for payday loan SEO marketing. Ensure your website displays proper disclaimers, licensing info, and responsible lending language. Review Google’s policies for financial services and update your content accordingly.

- Use Clear and Honest Language: Keep your messaging straightforward and compliant across titles, descriptions, and body content. Don’t trick users with clickbait. What they see is what they should get. Write with borrower clarity in mind, and not just SEO.

Getting your payday loan website noticed isn’t easy, but with the right SEO strategy, it’s absolutely possible.

With focused keyword targeting, thought leadership content, high-quality backlinks and a technically sound website, you can make your website easily discoverable by the right people at the right time.

Remember, the best SEO for payday loans doesn’t produce short-lived, overnight results. Instead, it gives consistent, long-term visibility your business needs to grow in the long run.

Ready to unlock the potential of SEO for payday lending for your brand? Book a free SEO consultation to explore our comprehensive payday loan SEO services.

FAQs

How long does SEO take for payday lenders?

On average, it takes around 3 to 6 months to see noticeable improvements in traffic and rankings. Working with an experienced SEO agency for payday loans can accelerate this timeline with the implementation of tailored strategies from day one.

How do payday lenders stay compliant with Google’s guidelines?

You can stay compliant with Google’s guidelines by following ethical SEO practices, using approved financial disclaimers, avoiding misleading claims and staying up to date with the latest policies related to search engine optimization for payday loan companies.

What metrics should I track for payday lender SEO?

Monitor organic traffic, keyword rankings, bounce rate, time on site, and conversion rates. Tools like Google Analytics and Semrush provide valuable insights to help you refine your strategy and measure the ROI of your SEO efforts.

About the author

Share this article

Find out WHAT stops Google from ranking your website

We’ll have our SEO specialists analyze your website—and tell you what could be slowing down your organic growth.

What People Say About Us

Hear from our clients about their experience with our high-quality SEO services.

Join the 2500+ business that trust our SEO optimization services

5

5