12 Insurance Marketing Ideas You’ll Ever Need In 2024

By: Hanson Cheng | Updated On: January 23, 2024

Table of Contents

Are you having trouble creating an impactful marketing strategy for your insurance agency?

You’re not alone.

Thousands of insurance marketers are actively looking for ways to drive more conversions. Fortunately, this shouldn’t be much of a challenge in today’s digital world since the vast majority of insurance consumers begin their journey online.

In this article, we have put together 12 marketing ideas that you should invest in to acquire more policyholders in 2024 and beyond.

Want to see your website at the top? Don’t let your competitors outshine you. Take the first step towards dominating search rankings and watch your business grow. Get in touch with us now and let’s make your website a star!

1. SEO Marketing Strategy

If you want prospective clients to find your agency easily, then you must optimize it for the search engine.

A successful SEO marketing strategy will help your insurance website rank higher on the search engine results. Getting to the highly-coveted top spots in search results means greater online exposure and higher organic traffic to your website.

For the best results, you should implement a mix of both on-page and off-page SEO techniques – Some helpful SEO tips to include in your marketing strategy include.

- Adding meta-descriptions and title tags to your content

- Making your website mobile-friendly

- Creating high-quality content that matches user-intent

- Ensuring your website loads faster

- Adding lots of quality backlinks

- Using high-quality visual content

- Optimizing for social signals

- Adding an XML sitemap for search engines to crawl and index your website easily

2. Blogger Outreach

Blogger outreach is a cost-effective outbound marketing strategy that helps insurance agencies build authority on the web.

It involves reaching out to industry leaders and other authoritative websites for a guest post opportunity. Once approved, you should create a high-quality article for the website and get a contextual backlink to your insurance website.

It’s always a win-win situation where the publishing website benefits from high-quality content while your website enjoys referral traffic and higher domain authority on Google.

Although blogger outreach takes time, the quality of connections and backlinks you receive make it one of the most productive strategies in the long term. Moreover, Google penalizes websites that use spammy link-building practices, so blogger outreach gets your website a nod from the search engine.

3. Local SEO

Local SEO is all about making your agency easy to find in a particular location. The aim is to ensure clients and prospects within the target location can easily find your website and social media profiles.

To achieve this, you start by claiming a Google My Business listing. Once you’ve obtained a listing, you must provide updated business information, including the name, address, website URL, working hours, social profiles, and contact information.

By doing so, your business listing has a higher chance of showing up in the search results, as shown below.

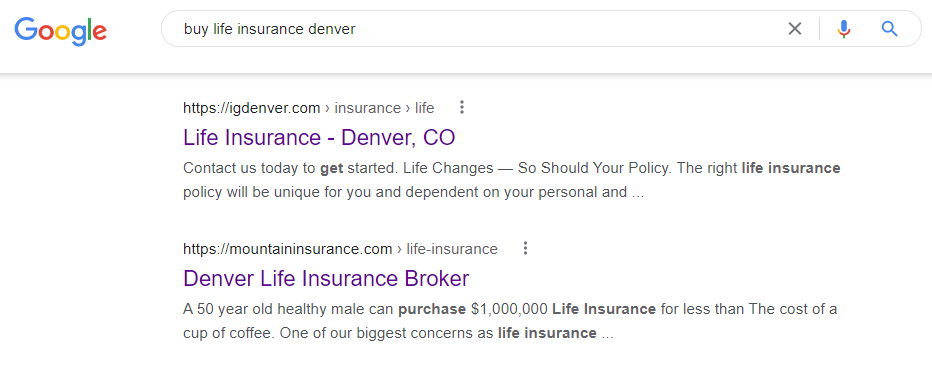

Another effective way of optimizing your website for local search is creating geo-targeted pages and blog posts for every insurance service. Think of a client looking to purchase a life insurance cover in Denver. When you perform a Google search for the target keyword “buy life insurance Denver” and this is what comes up in the search results.

Without localized content, your agency has no chance of appearing in the search results. This means you might be leaving tons of opportunities on the table.

4. Monitor Your Online Reviews

97% of customers read online business reviews, while 85% trust them as much as personal recommendations.

This means that reviews left by previous clients can make or break your insurance business. For this reason, it is always great to encourage satisfied customers to leave behind positive reviews.

Positive feedback on Google, Facebook, and review websites like Yelp are instrumental in helping potential clients choose your agency.

While requesting positive reviews, you should also deal with negative reviews proactively. An ideal way of handling negative reviews is following up with the policyholder and finding a way to address the situation. Once you find an amicable solution and the issue is resolved, you can acknowledge it online so that viewers understand your agency cares about its customers.

5. Ensure Brand Consistency

As with any other marketing strategy, you must maintain consistent messaging and brand image.

This starts by designing a professional logo for your agency. Besides the logo, you should ensure the content you post on your website, as well as social media platforms, portray the same brand messaging.

When responding to messages, phone calls, emails, tweets, reviews, mentions, and social media comments, always strive to maintain your brand tone. Giving clients and prospects a similar encounter across the board enhances brand recognition.

6. Implement Content Marketing

We can agree that insurance products can be really difficult to sell. An effective content marketing strategy makes things easier by helping your agency engage with potential clients all-year-round.

However, this doesn’t just happen by posting regular articles. You must stay ahead of the pack by consistently sharing high-quality content on your website, blog, and social media pages.

The goal is to make your agency a trusted and reliable source of information within the insurance space; so, be sure to publish original and genuinely useful content for your target audience.

A well-implemented content marketing plan helps you build a loyal customer base and stay at the forefront of your reader’s mind. This eventually makes it easier for you to acquire new policyholders.

7. Video Marketing

Video marketing is one of the best ways to supercharge your insurance marketing efforts. This is why 87% of marketers use video content as part of their strategy.

As an insurance marketer, you can use video editing software to create the following types of videos for your agency:

- Testimonials by policyholders- Instead of creating self-centered videos, you can highlight the experience of previous customers by featuring them in your videos. When a policyholder tells their story and how your agency helped them, your brand attracts more attention from the target audience.

- Insurance tutorials – Most insurance concepts are too complicated and confusing for consumers to understand without expert advice. Creating informative video tutorials on these subjects can help educate your audience and position your agency as a thought leader and industry expert.

- Proof of corporate social responsibility – Consumers expect insurance agencies to showcase their commitment to society. You can create videos demonstrating your agency’s values and social responsibility initiatives.

- Risk management tips – Offering risk management resources in video form is a great way to provide value to your clients.

- “Who We Are” or “About Us” videos – This involves sharing brief and informative branding videos that touch on your agency’s values, services offered, and the markets served.

8. Promote Your Social Media Posts

A report on social media use by insurance companies shows that all top 20 global insurers have a huge presence across all social platforms. This implies that insurance agencies looking to grow and nurture their business in 2024 should ramp up their social media marketing efforts.

To maintain an active social presence, you should get creative and share engaging content that appeals to the target audience. Other than posting valuable content, you can work with influencers to increase brand exposure and promote your content to a larger audience.

Another effective way of increasing the reach of your posts on social media is by using paid ads. You can run ads on Facebook, Twitter, LinkedIn, YouTube, Instagram, or any other platform. The good thing about paid lead generation is that you can target a specific location, demographic, or group of audience that is more likely to convert.

9. Improve Your Email Strategy

Email marketing is still one of the most effective channels for communicating with prospects and customers, regardless of your online niche market.

As an insurance agent, you should build a marketing system that allows you to make the most of your email list.

For instance, send a personalized email thanking the customer for doing business with you, or offering them a discount on their premium for every referral. The good thing about email marketing is that you can automatically create an email sequence to send targeted emails to your customers.

For even better results, consider the following tips when executing your email marketing campaigns:

- Create a killer subject line

- Answering commonly asked questions through emails

- Sharing newsletters via email

- Using a strong call-to-action

- Using an auto-responder

10. Consider Automated Marketing Strategies

There are tons of tools that you can use to streamline and increase the efficiency of your daily marketing tasks. Instead of spending a couple of hours every day working on repetitive marketing tasks, why not automate?

The good thing about automation is that it can be applied in a number of ways- from social sharing and lead tracking to email filtering and marketing analytics.

Using automated marketing strategies will help you to streamline lead generation, lead nurturing, and lead scoring. This, in turn, boosts customer retention and increases the overall ROI of your marketing initiatives.

11. Host Educational Webinars

Hosting webinars, whether live or pre-recorded, is an effective way of generating leads, acquiring new business, and educating existing customers. You can host webinars to inform potential clients about the services you provide and their benefits.

Additionally, you can share valuable information on different aspects that are tied to insurance. For instance, you can educate them on topics like “How to choose the best insurance policy” or “7 things you should know about your Fire Policy Insurance Cover.”

There are unlimited insurance content ideas that you can cover when organizing a webinar or creating a podcast. You only need to ensure that your content is relevant and engaging to the target audience.

12. Join a Business Networking Group

If you want to make more contacts and establish better relationships for your agency, then business networking should be part of your plan. This means joining and attending group events, business meetings, club meet-ups, workshops, and conferences as part of your networking efforts. Through these networking events, you can form productive business relationships, share creative solutions, identify business opportunities, earn referrals, or even seek potential venture partners for your agency.

There’s much more that goes to marketing your insurance agency than just generating prospects. Part of your efforts should focus on improving thought leadership and industry expertise. This explains why you should join a networking group to expand your source of knowledge, expertise, and resources for running and growing your insurance agency.

Another benefit of joining a business association is that it makes it easier for your agency to keep up with the latest trends and developments within the insurance space.

Conclusion

There you go! You have 12 actionable marketing ideas for growing your insurance agency. Hopefully, you can use these tips to inspire your marketing campaign and take your insurance agency to the next level.

Get Your Free SEO Audit Now!

Enter your email below, and we'll send you a comprehensive SEO report detailing how you can improve your site's visibility and ranking.

You May Also Like

Turnaround Time (TAT) for SEO Projects: How Agencies Set Expectations

As an agency owner, the key to delivering a faster ROI for your clients is promptly implementing the proper SEO strategies. However, managing hundreds of client websites simultaneously means each client expects rapid results. That’s why your SEO agency must set clear expectations about turnaround time (TAT) with your clients, ensuring they understand the process … Turnaround Time (TAT) for SEO Projects: How Agencies Set Expectations

6 SEO Pricing Models for Agency Owners

When it comes to SEO service pricing, it can be difficult to know what is a fair price and what is too much. Read this blog to know more.

What’s a Good Click-through Rate?

Checkout some of the most effective ways to improve the CTR (Click Through Rate) which is one of the hidden search engine ranking factors.

Comments

1 Comment

Hi Hanson,

Most companies, including insurance companies, don’t have time to write thorough blog posts on a consistent basis. Hiring a digital marketing freelance, or just a good content writer, is a great option.

Thanks for the post.